FREQUENTLY ASKED QUESTIONS

Customer Comms

Collect Your Visa AA EC Dollar Renewal Credit Card - October 15 2023

Debit and Credit Card Tips - July 19 2023

Visa AA EC Dollar Credit Card Renewal - October 7 2023

Debit and Credit Card Tips - July 19 2023

Product Changes New edit Email - March 13 2023

Discontinuation of Cheques on Savings Accounts - March 10 2023

Update your Payment Information - March 1 2023

Our Continued Commitment to Service Excellence - Feb 7th 2023

New Location for the Collection of Cards and Online Banking Credentials - Feb 2nd 2023

Paying your Credit Card Online and on Time - Feb 1 2023

Managing Your Credit Card PIN - Jan 27 2023

A Reminder to Update Your Payment Information - Jan 25 2023

Change in Branch Services Offered at Locations - Jan 23 2023

Migration to ECAB MOREBanking - Jan 15, 2023

Postponed ATM Service Interruption Woods Branch - Jan 12, 2023

Branch Closures - Integration Preparation - Jan 9, 2023

Scotiabank Branded Cheques and Routing Numbers Discontinued - Jan 5, 2023

Integration ATM Service Interruption - Jan 4, 2023

Your New ECAB Credit Card - Dec 23, 2022

Integration Day - What You Need to Know - Dec 21, 2022

Payroll Services Migration - Dec 2, 2022

Resource Docs

Branches & ATMs

From January 23, 2023, you will have the convenience of conducting your banking at ANY of our six (6) branches or ATMs located across the island.

|

Branch Location |

Services Offered |

|

Coolidge |

• Drive-Thru Banking (All customers) • In-branch services for Small Business and Commercial Banking |

|

Dockyard |

• Teller/Cash Operations/Customer Service |

|

High Street |

• Teller/Cash Operations • Retail Lending |

|

Redcliffe Street |

Customer Service |

|

Woods Branches |

Full-Service Banking/Retail Lending |

Please see the below ATM locations.

|

LD 2 Locations |

No. of ATMs |

|

1st Choice Foods - Anchorage Road |

1 |

|

Epicurean Fine Foods & Pharmacy - Friars Hill |

1 |

|

High Street Branch |

2 |

|

Jolly Harbor – Commercial Center |

1 |

|

Woods Center |

2 |

|

Coolidge Branch* |

3 |

|

Dockyard |

1 |

|

Redcliffe Street |

2 |

|

Perry Bay |

1 |

|

AUA |

1 |

* One(1) of the three(3) ATMs are for the Drive-Thru Banking Service

Our ATMS provide a range of banking functions making it easy for you to conduct your banking without having to come into the branch.

- Cash withdrawals up to$5,400 using your ECAB Debit Card

- Cash/Cheque Deposits (Cash and ECAB Cheques deposits before 1 p.m. on business days are credited to your account the same day)

- Account balance checks

- APUA bill payments

- Cash Advances

While we are committed to giving you convenient banking options, the Cash Back service will be unavailable as of January 23, 2023. However, we take this time to remind you that cash and ECAB cheques deposited at our ATMs before 1:00 p.m. on business days will be processed and credited to your account on the same day. Non-ECAB cheques will be made available on the 2nd business day after being deposited at the ATM.

Debit Cards

ECABs Visa Debit Platinum Card combines all the advantages of a Platinum Card. See information on collecting and managing your new card.

Collection of Cards

Your debit card will be transitioned to an ECAB VISA Card. If you have not collected your card, please speak to a Customer Service Represent about collecting your card.

Customers with an active former BNS debit card (the red or green card) should collect their new ECAB Visa Platinum Debit cards.

• Business customers, who are not sole proprietors, are not required to collect a card. • Customers of both legacy ECAB and former BNS, who already have an ECAB Visa Platinum debit card, are not required to collect a card as your accounts will be linked to your existing card.

Your card can be collected from the following locations:

| Last Name | Location |

|---|---|

| A to E | Woods Branch (former BNS location) |

| F to O | High Street Branch (former BNS location) |

| P to Z | Redcliffe Street Branch |

| Business Customers | Coolidge Branch |

Card Pin

Cardholders will be issued with a unique PIN when they collect their card at the branch. After system migration is completed, customers can re-PIN their card in branch.

If you have forgotten your PIN, you can visit any ECAB branch to have it re-PINNED.

There are no restrictions on the number of times you change your PIN.

Card Benefits

ECAB Visa Debit Cards offer a wide range of consumer benefits such 24-Hour Customer Service, ATM Protection, Price Protection, Purchase Protection, Concierge Services, Chip & PIN Technology and Contactless Payments. Please visit our website to review the list of benefits.

Debit Card Transactions

Your debit card transactions can be viewed via MOREBanking online or the mobile App. Once you have received your login details, you can access the platform to view all transactions.

The denial fee is a fee that is incurred when the cardholder attempts to perform a card transaction when there are insufficient funds held on the account. A charge will be incurred for every failed attempt. We encourage cardholders to monitor account balances using theMOREBanking online or mobile service to prevent such charges.

There is no minimum transaction amount for debit card transactions.

Account Services

It is recommended that you advise the Bank where and for how long your intended travel will be, so a record can be placed on your account and it is known that any card transactions from that location were likely authorized by you and not used fraudulently.

Cardholders should e-mail the bank at info@ecabank.com or send a secure message via ECAB MOREBanking online or mobile app providing details of your upcoming travel. Please ensure you include your intended destination and departure and return date.

Fraud & Security

You can report fraud by calling 268-480-6187 or visiting any of our branches during our normal operating hours. For after-hours service you may call any of the numbers at the back of your card.

You will be required to complete the Bank's dispute form in order to initiate a dispute. The form can be obtained from any of our branches or arrangements can be made to have the form emailed to you.

Cardholders should frequently monitor their accounts and immediately report any unknown or unauthorized transactions.

The dispute process can take up to 180 days.

Credit Cards

Our full suite of Credit and Prepaid Cards give you the flexibility of choice as well the rewards to match your lifestyle. Find out more about collecting and managing your card.

Card Collection

Your credit card will be transitioned to an ECAB VISA Card with your usual limit and any outstanding balance. If you have not collected your new ECAB card, please speak to a Customer Service Represent about collecting your card.

A new account number will be assigned to your ECAB Visa credit card. This number will be provided upon collection of your new card. Please secure your account number as it will be required to make payments via our MOREBanking online/Mobile banking app. You will also be provided with information on how to manage your credit card account online. This will allow access to your transaction history and card balance via the Caribbean Card Mobile app, which can be downloaded from the Google Play or Apple stores. Your new credit card will allow you to enjoy rewards points which you can redeem for travel, local and overseas purchases and various other activities through the Visa My Rewards Program. To learn more about our card products, you may visit our website at www.ecabank.com or contact our Client Services Centre at (268) 480-6187 or info@ecabank.com

| Last Name | Location |

|---|---|

| A to E | Woods Branch (former BNS location) |

| F to O | High Street Branch (former BNS location) |

| P to Z | Redcliffe Street Branch |

| Business Customers | Coolidge Branch |

Cards can be collected between the hours of 8:00 a.m. to 2 p.m. Monday to Thursday and 8:00 a.m. to 3 p.m. on Fridays.

Please be advised that you must be up to date on your monthly payments to collect your new card. All cardholders are encouraged to continue to make the monthly minimum payments on your card account by the scheduled due date.

You can contact 480-6187 or info@ecabank.com for any questions or concerns regarding your card.

Yes, we are asking all former BNS customers to collect their new card no later than January 13, 2023. While you should continue to use your current card, as of January 20, 2023 your current card will be deactivated. Until that time, please keep your new card and card information in a safe place.

Card PIN

To create your unique PIN, visit www.ecabank.com and login to the ECAB Credit Card Online Portal using the username and password received in your credit card package and follow the steps below:

1. Select Preferences

2. Verify your contact information

3. Select change PIN

4. Enter your new 4-digit PIN

5. Select “Change PIN” to confirm your PIN

If you have forgotten or want to change your PIN, visit www.ecabank.com and login to the ECAB Credit Card Online Portal using your username and password and follow the steps below:

1. Select Preferences

2. Verify your contact information

3. Select change PIN

4. Enter your new 4-digit PIN

5. Select “Change PIN” to confirm your PIN

No, once you have logged into the card portal, your credentials are verified, and you can freely create a new PIN of your choice without having to remember your old PIN.

There are no restrictions on the number of times you can change your PIN.

Card Benefits

ECAB Visa Credit Cards offer endless possibilities and peace of mind as an ECAB cardholder. Our cards provide a wide range of consumer benefits such as Auto Rental Insurance, Visa Rewards or AAdvantage Miles, emergency card replacement, travel accident insurance, extended warranty and more. Please view the list of benefits available for your card here.

Please view the full list of charges and fees associated with your card here.

While your new card will not be co-branded with the American Airlines AAdvantage program, you will continue to earn and received AAdvantage Miles.

You can apply for an ECAB credit card online by visiting www.ecabank.com or click here to apply today.

ECAB offers a full suite of Credit and Prepaid Cards giving you flexibility of choice as well as benefits and rewards to match your lifestyle. Learn more about our card products here.

Yes. ECAB will be launching Mastercard products in the near future. Once available, customers will have the option to switch to a MasterCard product.

My Rewards

My Rewards is a loyalty program offered to credit cardholders. My Rewards is the next generation of rewards and digital payments, offering multiple ways to earn and redeem rewards points on mobile devices, online or in store by simply using their linked Visa credit card. Redeem points every day at your favorite stores. Add your Reward Card to your e-wallet and redeem anywhere, even contactless, globally, locally, anywhere, anytime at 61 million merchants worldwide. Access the best Expedia travel deals on your favorite airlines, hotels and activities at the best prices.

You are automatically enrolled into My Rewards once you have a valid email address on your credit card account. However, to access My Rewards, you will need to either download the My Rewards App from the Google/Apple Play Stores or visit www.go2redeem.com and click sign in. Then click “Still Not Registered with My Rewards”. Enter your email address linked to your credit card and a confirmation email will be sent to your inbox. This will allow you to setup your password and load your My Rewards profile.

Once registration is complete with My Rewards, an image of a virtual card with your points balance will be displayed. Tap on the card to view your virtual card number and details. You can copy this card number into your online checkout to pay using your points balance. You can also redeem your reward points via contactless payments locally or overseas via a mobile wallet such as Google Pay, Samsung Pay or Apple Pay.

Even if you haven’t earned enough miles for your purchase, you can split your payment with your preferred card. My Rewards gives you the freedom to shop the way you want! The My Rewards Smart Agent is also available to help you from the app or via WhatsApp, iMessage or Facebook Messenger.

Points are earned on eligible purchases. Points are not earned on cash advances, fees, credits, interest, or payments to your card’s outstanding balance.

Once you have logged into My Rewards, you can select a virtual card and view your points.

Go to your My Rewards account through the app or visit www.go2redeem.com. Enter the email address associated with your card and then click forgot password to create a new password.

First, please ensure you have entered your email address and card details correctly. You may also contact our Card Services Department at cardservices@ecabank.com to confirm that the email address you entered is correctly updated on our records.

You may add your My Rewards virtual card details to an electronic wallet such as Apple Pay, Samsung Pay or Google Pay. You will then enable this feature on your smartphone to checkout in person using NFC (near-field communication) on your device. Simply enable, tap and go at merchants who accept contactless payments.

Login to the My Rewards App to familiarize yourself with the features and learn more about the My Rewards program. The My Rewards Smart Agent is also available to help you from the app or via WhatsApp, iMessage or Facebook Messenger.

Credit Card payments can be made through the ECAB MOREBanking online or mobile banking app. The app “ECAB Mobile” can be downloaded from the Google Play and Apple Play stores.

Credit Card Payments

Visit the ECAB website, enter your log in credentials. Select Payments then Pay merchant. Select ECAB Credit Car merchant and then the account to be debited for the Credit Card payment.

Your credit account number is used to register your credit card in MOREBanking

Complete the ECAB ALCHMEY Payment order form and deliver it to an ECAB Customer Service Representative for processing.

Online payments processed to USD cards before 10:00 p.m. are applied the next day by 12 noon. Payments made in branc are applied to cardholder's account same day after 7 p.m. Arrangements can be made for immediate payment. Requests fo immediate payments can be submitted via secure message via online or mobile banking or a Customer Service Representativ at any of our branches can provide guidance on this process.

Recurring credit card payments can be scheduled through the ECAB MOREBanking online or mobile app. Login the ECA MOREBanking, select Payments then Pay merchant. Select account and enter the amount to be paid. In the Schedule Paymen section, set the frequency and date for the recurring payment.

Yes. Cardholder's can make additional or full payments to reduce the outstanding balance on their credit card account

The minimum payment is 5% of the outstanding balance - minimum EC$67.50.

Late fees are charges that apply to a credit card account if cardholder fails to meet their minimum payment by th statement due date.

A payment is termed as late when the payment is made after the statement payment due date.

Account Services

A request for a credit limit increase should be made in writing to a Customer Service Representative at any branch.

It is recommended that you advise the Bank where and for how long you intend to travel. A record will be placed on you account, so it is known that any card transactions from that location were likely authorized by you and not use fraudulently.

Cardholders should e-mail the Cards Services Department at cardservices@ecabank.com or send a secure message via ECAB MOREBanking online or mobile providing details of your upcoming travel. Ensure to include your intended destination and departure and return date.

The principal applicant must send a letter to the bank with the relevant instructions and details of the additional cardholder.

Visit the ECAB website and login to Credit Card Online. Select transaction. You can also view your card transactions in the Caribbean Cards Mobile App.

Credit Card Replacement

If your card is stolen or lost, report it immediately by calling any of the numbers on the back of your credit card. You can also report it via MOREBanking under Services, Report Stolen/Lost Card or call or visit any of our branches to make the report. Once a report is made, the card will be blocked immediately to avoid any further transactions being processed on the card.

No. Only the card that is lost or stolen will be replaced. Other cardholders on the account will be able to continue to use their cards.

Send a secure message via ECAB MOREBanking mobile app or online or email the Card Services department - cardservices@ecabank.com to confirm receipt.

The cardholder can send a secure message via ECAB MOREBanking mobile app or online or visit any ECAB Branch to complete a Card Replacement Form.

We issue renewal or replacement cards up to two months before the current card expires. Your card is valid through the expiration date printed on your card.

Fraud & Security

You can report fraud by calling 480-6187 or by visiting any of our branches during our normal operating hours. For after-hours service, you may call any of the numbers at the back of your card.

The bank assumes the liability of Credit Card Fraud transactions. However, the bank does not take liability for International Debit Card fraud transactions.

The customer will be required to complete the Bank's dispute forms to initiate a dispute/chargeback request. The form can be obtained from any of our branches or arrangements can be made to have the form e-mailed to you.

Cardholders should immediately report any unauthorized transactions on their card. Disputes should be processed within 120 days of the date of the transaction.

The dispute process can take up to 180 days.

Online Banking

Think Outside the Bank. Our MOREBanking Online and Mobile provides you with all the features you need to bank at your convenience.

No. Prior to integration day, January 23, 2023, you will be contacted to collect your new login online/mobile credentials. To access MOREBanking via a mobile device, please download the ECAB Mobile App from Google Play or the Apple Store. You may also login via your web browser by visiting our website www.ecabank.com and selecting “Online Banking Login”.

Please refer to the MOREBanking User Guide and Help Videos in the Integration Hub to learn more about MOREBanking.On January 20, 2023 from 5:00pm, your current online/mobile banking platform and login credentials will be disabled. Your accounts will be transferred to our ECAB MOREBanking platform between January 20 and 22 2022 at which time you will not be able to access online or mobile banking services.

Effective January 23, 2023, when the integration process is complete, you will have full access to ECAB MOREBanking’s complete suite of products and services allowing you to perform a range of banking transactions at your convenience.

To access MOREBanking via a mobile device, please download the ECAB Mobile App from Google Play or the Apple Store. You may also login via your web browser by visiting our website www.ecabank.com and selecting “Online Banking Login”.

All customers are encouraged to download and save statements from your current online application up to January 20, 2023 as there will be a delay in the availability of historical statements. Historical statements will be available by March 31 2023.

If you have not received your online and mobile banking credentials or if you have trouble logging in, please feel free to contact us at 480-6186/7 or info@ecabank.com if you have any issues with our MOREBanking platform.

Wire Transfers

Transfer funds across the world quickly and securely. Take note of new Incoming wire and routing number details.

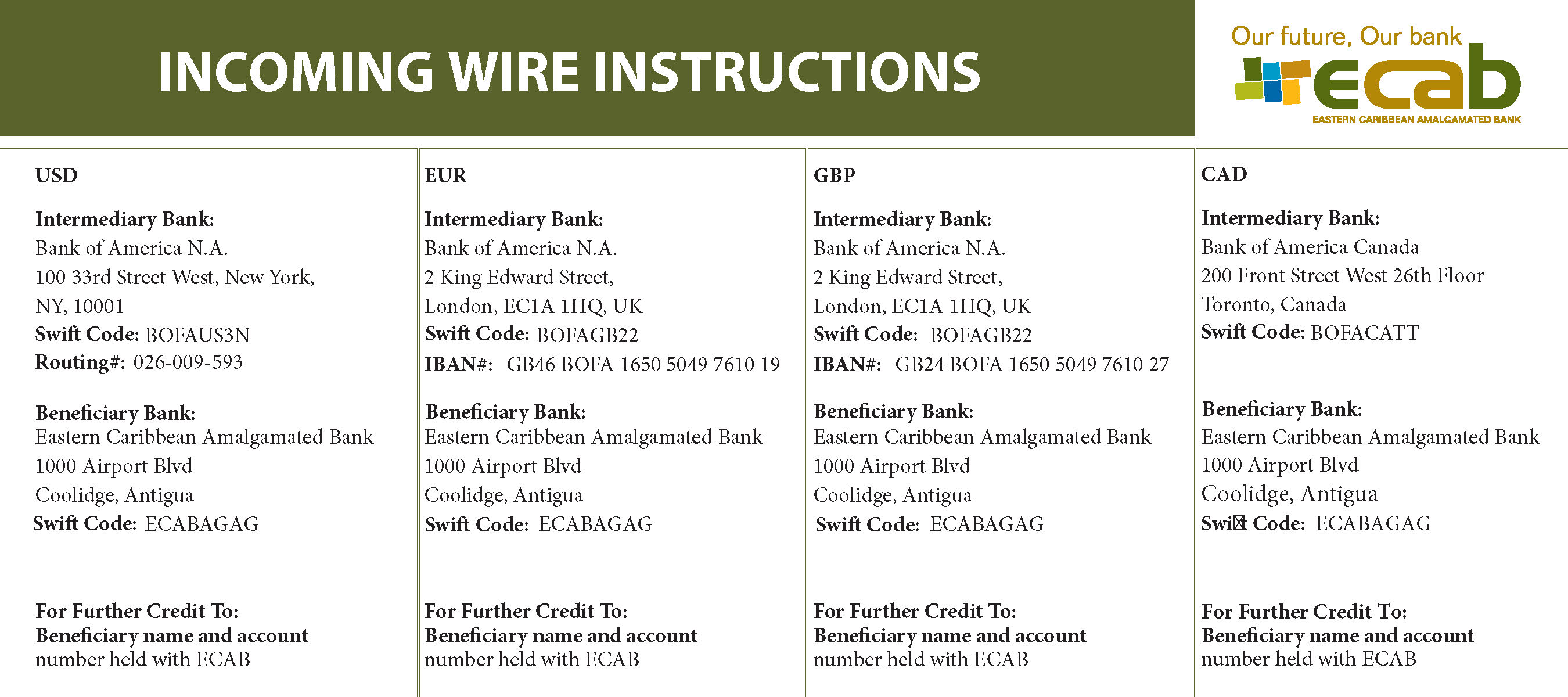

Yes. Please note that as of January 23, 2023, the use of swift code ECABAGAG001 will be discontinued and must be replaced with ECABAGAG. Please update your incoming wire instructions with the following details:

Please be reminded that you must provide the remitter of funds with the correct wire information for incoming wires to be successfully received. You are encouraged to verify the beneficiary’s/recipient’s banking information before attempting to process an outgoing wire. Incorrect or incomplete information will result in delays or the return of funds. Wires sent to us using incorrect information will not be received.

Customers who receive SWIFT MT940/950 messages will continue to receive them after integration day.

As of January 23, 2023, the use of the former Scotiabank routing numbers should be discontinued and must be replaced with ECAB routing number 000000712. To receive EFT payments, provide the remitter with the following:

- Account Name: Beneficiary Account Name

- Account Type: Beneficiary Account Type

- Account Number: Beneficiary Account Number

- EFT Routing No.: 000000712

- Bank Name: ECAB

Deposit Accounts

We offer a range of deposit accounts to fit your needs. Note changes to account numbers, names and rates.

Commencing January 23, 2023, with the exception of loan and time deposit interest rates, your banking products, rates and fees will be adjusted to reflect ECAB’s current products, interest rates, fees and charges. Please visit the Integration Hub section to view ECAB’s Product Conversion Guide and our schedule of fees and charges.

As of January 23, 2023, you may apply for new products or services from any of our branches. Appointments can be online through the appointment portal on www.ecabank.com.

Yes, however, effective January 23, 2023, all USD savings will be converted to ECAB’s USD Savings Product at ECAB’s terms and conditions.

Your CD interest rates will not be affected immediately but will come over to ECAB at the current applicable Scotiabank rate. However, as your CDs mature, the interest rates will be converted to ECAB rates.

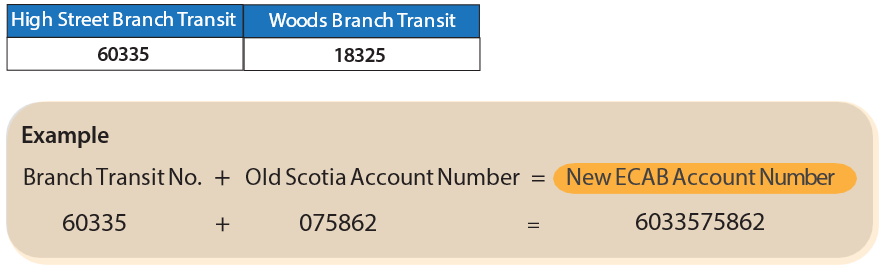

Yes, your account number will change. Your new account number will be a combination of your branch transit and your existing account number.

Example

If you wish to confirm your account number, it can be viewed through the ECAB MOREBanking online or mobile App. Similarly, if you have any questions regarding your new account number you may contact our Client Services Centre at (268) 480-6187 or info@ecabank.com or speak to a Customer Service Representative at any branch.

Loans & Mortgages

There will be changes to some products. See below how you may be impacted.

You will continue to enjoy the terms and rates of any existing loan as the terms and rates remain unchanged. Should you wish to make any inquiries regarding your loan or apply for a new loan, you may do so by contacting our Loans Team at 480-6090 or creditadmin@ecabank.com.

Kindly note that as of January 23, 2023, an NSF charge of $75.00 will be applied to all cheques written against accounts with insufficient funds. The charge will be applied whether the cheque is honored or returned.

If you wish to apply for a loan, you may do so by contacting our Loans Team at 480-6090.

All customers with the Scotialine product will be issued a Visa credit card as the Scotialine product is being discontinued. Your Scotialine will now only be accessible via your credit card. Transfers from your card account to your deposit account can only be completed by withdrawing cash via the ATM and depositing funds to your account. If you have questions or concerns about the transitioning of your Scotialine, or if you wish to close your card account and apply your limit to a current account with cheque writing or debit card privileges, please call 480-6090.

There will be no change in the processing of your domestic and cross-border trade finance transactions. You may call our Retail and Commercial Lending team at 268-480-6090 or email creditadmin@ecabank.com for any questions or concerns about migration of existing facilities and for new requests.

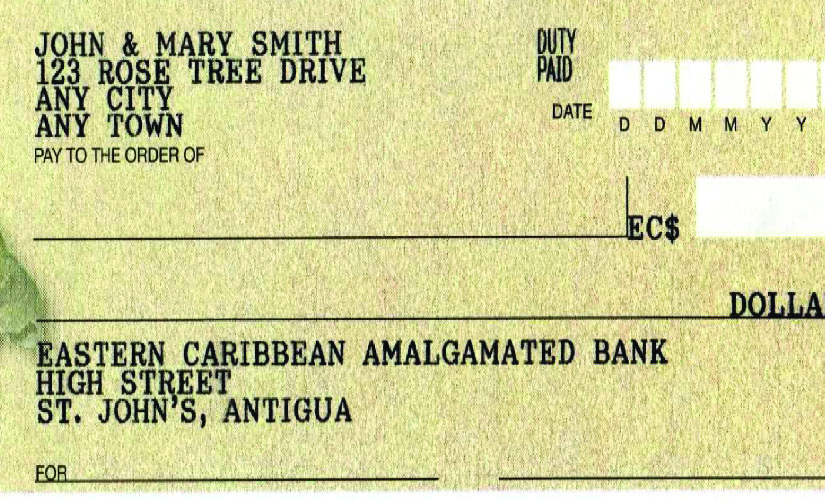

Cheques

Managing your current Cheque stock is important. Find out about ordering new checkbooks.

As of January 23, 2023, all cheques will be printed with ECAB’s routing number 00000071.

Existing Scotiabank branded cheques and cheques bearing the Scotiabank routing numbers (60335002 and 18325002) will be honored until July 20, 2023. However, we ask that you limit your reorder quantities of cheques with the Scotiabank routing/transit numbers to last no longer than January 2023.

As of January 23, 2023, you can place your cheque book orders via the online/mobile application or in branch. The new routing number for cheques is 000000712.

You may continue to order your personalized or commercial cheques from Moore Paragon. The current process for placing orders remains in place or you may email mpccustomerservice@rrd.com for customized cheques (company branded cheques) or make the request via ECAB branches.

Customers who intend to continue to print their own cheques are asked to write to the bank advising of this and to provide five sample cheques for testing before proceeding to print cheques with the new routing number. Cheques should comply with the Canadian Payments Association Standards 006.

Banking Services

Integration will change some banking services like in-branch card swipe and banking fees. Find answers to your questions below.

Due to a delay in the implementation of our Card Swipe feature, you must complete vouchers when completing in-branch or drive-thru deposits, withdrawals or other transactions until we finalize the Card Swipe implementation. Our vouchers are easy to use and will allow you to complete your transactions quickly and efficiently. For more information on how to complete the vouchers, please view our help videos via the Integration Hub on our website or ask for guidance in-branch.

With the exception of Canadian (CAD) drafts, you may continue to purchase or negotiate foreign currency drafts (GBP, EUR and USD). An alternative to CAD drafts is CAD wire payments. Same day draft collection will become available in branch as of January 23, 2023 . Drafts can be ordered through our MOREBanking platform.

Commencing January 23, 2023, rates and fees will be adjusted to reflect ECAB’s current products, interest rates, fees and charges. Please visit the Integration Hub section to view ECAB’s product conversion guide and our schedule of fees and charges.

All customers are encouraged to download and save statements from your current online application up to January 20, 2023 as there will be a delay in the availability of historical statements. Historical statements will be available by March 31 2023.

Your standing orders will automatically be migrated and will continue uninterrupted. ECAB fees and charges will be applicable from integration day.

In anticipation of the completion of the integration of former Scotiabank accounts into our portfolio, it is imperative that you advise us if you wish to discontinue your existing standing orders between legacy ECAB and former BNS accounts. If you wish to discontinue your existing standing order arrangement, please visit the branch and complete the Standing Order Cancellation Form. If you wish to continue with your existing standing orders, then no action is required. Your standing order will be converted to an internal transfer.

Yes. Former Scotia customers will continue to access their boxes as customary. In order to facilitate the smooth process of rental fees and to avoid suspension of access, all customers with safe deposit boxes and/or night bag services are required to hold an active corresponding deposit account with sufficient available funds to allow for the automatic processing of annual rental fee payments which are due by the 2nd of January of each year.

Yes. Night deposit holders can continue to make deposits at their customary branch location.

Yes. We are pleased to advise that we will be migrating your online services to our MOREBanking platform from January 23, 2023. This will include migration of the following Cash Management Services:

- Third-Party Transfers

- Bill Payments

- Single Payments/Disbursements – One Time or Scheduled reoccurring payments

- Wire Transfers (USD/EUR/GBP/CAD)

- Electronic Funds Transfers (XCD)

Please note that cross currency transfers will no longer be available but can be requested via the Secure Message Centre within the MOREBanking application.

For processing Bulk Payments/Disbursements such as payroll, we will give you access to our ACH Payment Processing application. In preparation for this you will be invited to attend a demonstration of this application after which we will assign an officer to assist you with completing the application form and provide you with access to commence setup/transfer of payment details for your current payees. Please call 480-5367 to register for a general demonstration session.

Merchant Services & Payroll

All former Scotiabank point-of-sale terminals will be replaced or upgraded prior to integration. However, if your terminal has not been upgraded by January 13, 2023 or you have any questions, please contact our Card Services Department at 736-3222 or CardServices@ecabank.com.

Fees

Commencing January 23, 2023, with the exception of loan and time deposit interest rates, your banking products, rates and fees will be adjusted to reflect ECAB’s current products, interest rates, fees and charges. Please visit the Integration Hub section to view ECAB’s product conversion guide and our schedule of fees and charges.

Kindly note that as of January 23, 2023, an NSF charge of $75.00 will be applied to all cheques written against accounts with insufficient funds. The charge will be applied whether the cheque is honored or returned.

Stopped Services

No. Unfortunately, due to a delay in the implementation of our Card Swipe feature, we must ask you to complete vouchers when making in-branch or drive-thru deposits, withdrawals, or payments until we finalize the Card Swipe implementation. Our vouchers are easy to use and will allow you to complete your transactions quickly and efficiently.

All customers with the Scotialine product will be issued a Visa credit card as the Scotialine product is being discontinued. Your Scotialine will now only be accessible via your credit card. Transfers from your card account to your deposit account can only be completed by withdrawing cash via the ATM and depositing funds to your account. If you have questions or concerns about the transitioning of your Scotialine, or if you wish to close your card account and apply your limit to a current account with cheque writing or debit card privileges, please call 480-6090.

Please note that cross currency transfers will no longer be available but can be requested via the Secure Message Centre within the MOREBanking application.

While we are committed to giving you convenient banking options, the Cash Back service will be unavailable as of January 23, 2023. However, we take this time to remind you that cash and ECAB cheques deposited at our ATMs before 1:00 p.m. on business days will be processed and credited to your account on the same day. Non-ECAB cheques will be made available on the 2nd business day after being deposited at the ATM.

Help Videos

How To Videos

How to sign up for ECAB VISA My Rewards

How to Insert Your Cards at ECAB ATMs

In-Branch Vouchers: Customer Withdrawals

In-Branch Vouchers: Customer Deposits

In-Branch Vouchers: Third Party Payment Deposits

MOREBanking: Peer to Peer Payment

MOREBanking: Merchant Payments

MOREBanking: EFT Payments

MOREBanking: Scheduling Payments

MOREBanking: Create Wire & EFT Payment Templates

Interviews

ECAB Interview on Observer AM - March 22, 2023

Observer Radio Post Integration Interview with Sonya Roberts-Carter - Feb 6, 2023

Commercials

ECAB MOREBanking

ECAB Alternate Banking Channels

The Power of You

ECAB Your Financial Partner for Life

Security Tips

ATM Security Tips No. 1

ATM Security Tips No. 2

ATM Security Tips No. 3

Contact Us

We are here for you to make this process easy for you. We stand ready to provide you with service of the highest standard.

As of January 23, 2023, customers may contact our Customer Support & Digital Banking Centre.

Please note that the former Scotia Contact Centre numbers will not be available from January 23, 2023.